Ahrms.jp

Newsletter of JVPA

Trend of Restructuring of Veterinary Products Industry and Volume 37

Current Status of Animal Business/

Traceability System of Cattle and Current Efforts

JVPA DIGEST, Volume 37 March 2010

Review: Trend of Restructuring of Veterinary Products Industry and Current Status of

Reference Information: M&A of Veterinary Products Companies

Information: Traceability System of Cattle and Current Efforts

Introduction of Members:

Sumica Enviro-Science Co., Ltd.

Serachem Co., Ltd.

Hayashi AgroScience Ltd.

Research Institute for Microbial Diseases, Osaka University

Pfizer Japan Inc.

Introduction of New Products from Members:

Nobilis AE/POX (Intervet K.K.)

Eprinex Topical (Merial Japan K.K.)

Bioymbuster tablet (Kyoritsu Seiyaku Corporation)

Mastrhizin (Kyoritsu Seiyaku Corporation)

Announcement: New Year Greeting Meeting for 2010 Held

Trend of Restructuring of Veterinary Products

Industry and Current Status of Animal Business

Yuki Ujimasa Director&President, AHRMS Inc.

A String of Major Mergers of Mega Pharmaceutical Companies

In January 2009, it was reported that the largest company in the world in the medical products for the human use (medical use) Pfizer (U.S.) purchases Wyeth (U.S.) and in March Merck (U.S.) which kept its pure blood until that time was reported to acquire Schering Plough (U.S.), confirming that the medical industry is still in the big wave of restructuring. In the 1990's, in the medical industry in the US and Europe, the business model to swallow the companies which had new drug development candidates through M&A (Merger and Acquisition) and obtain the new drug and many M&A deals were made with the purpose to expand the scale. This business model was called "Block Buster Model" and enabled the sustainable growth of the companies by continuously merchandising the medical products with the annual sales of more than one billion dollars and by introducing them in the global market. A medical product whose annual sale exceeds one billion dollars (approximately 100 billion yen) is called a block buster. However, it is more highly likely to fail than to succeed as it is often said that probability of success of new drug is thirteen thousandth, though if a new drug succeeds its profit rate is high and it contributes profit for many years until the patent expires. Therefore, in order to enhance the probability of success of new drug, the business model to purchase the companies with the development candidates through M&A, try the expansion of the scale and secure the development cost of the new drug was pursued competitively in the US and Europe. However, in reality, in many M&As, the new drugs which should have been supporting the sustainable growth were not successfully developed and the profit could not be maintained. Some of the companies which pursued this business model were harshly criticized by the stock market. Thus, since 2000, the M&A to pursue the acquisition of companies which have particular new drug candidates, bio-venture companies and antibody drugs have increased instead of this business model. However, I believe that it is partly because of the credit crunch due to the global financial crisis triggered by the subprime loan problem as well as the occurrence of the so-called "2010 Issue" where the patents of the new drugs expire around 2010 in succession and the a dash of introductions of inexpensive generic products that the so-called mega pharmas ranking in the 10 largest pharmaceutical companies come to make deals of major M&A repeatedly. The share of generic medical products in Japan still remain as low as less than 20% on quantity basis, though it amounts to nearly 60% in US and Europe on quantity basis with the majority of the market built by the new drug is to be replaced by the generic products. At Pfizer (U.S.), the US patent for hyperlipidemia drug Lipitor, which accounts for a quarter of its sales expires in 2010 and it is deemed certain that its generic products will be introduced into the market in 2011. Therefore, it is urgent to renew the pipeline of the next development candidates. Actually, it is believed that Pfizer (U.S.) established this "Blockbuster Model" first. Pfizer (U.S.) acquired Warner Lambert (U.S.) in 2000 and Pharmacia (U.S.) in 2003. It acquired hyperlipideia drug Lipitor and antiphlogistic analgetic Cerebrex through it, though the product that they grew in size from the research and development phase was Viagra and it is not yet ready to continuously introduce self-advocated blockbusters into the market. On the other hand, it is said that the growing trend of Merck (U.S.) collapsed all at once by the voluntary recall of arthritis drug VIOXX and several thousand law suits. The major new drug candidate, which attracted a lot of expectation, could not obtain the US FDA (Food and Drug Administration) and forced Merck (U.S.) to abandon the principle of pure blood and to shift to major M&A.

Big Wave in Animal Health Industry generated by M&As in Medical Industry

As a principle, the industry restructuring due to M&A of pharmaceutical companies mentioned above focuses on how to build the environment to input its maximum management resource (human, goods, money and information) into its core business, the medical products for human use. In negotiation for M&A, the top management of the companies agrees on the core business in the first place and then looks at various methods to realize it. Pharmaceutical companies and chemical companies have various business operations such as cosmetic business, food business and veterinary products business in which we are involved in addition to its core business (including the case where they own such businesses as subsidiaries). Those operations other than the core business are classified as relevant business, have different customers and are subject to different set of laws and regulations in general, with the different hardware such as the equipment to operate such business and the different software including knowledge, experience and know-how. These relevant businesses also contribute to the sales and profit of the company and it can't be helped that the negotiation on the integration of relevant businesses receive the low priority or deemed as the material for negotiation based on the principle of putting priority on the negotiation of the core business even though we may not say that the synergy with the core business is non-existent. The fact that a survey company in Japan called it "Wave of restructuring of mega pharmas, AH continues to be racked" (Note by Author: AH stands for Animal health, meaning animal health industry) represent the essential aspect of the things. In the merger of Pfizer (U.S.) and Wyeth (U.S.) as mentioned above, both companies had veterinary products divisions and their veterinary products divisions were integrated as with the business integration for medical products for human use. However, in order to respond to overseas anti-trust law (Anti-Monopoly Act in Japan), they assigned a part of their businesses in North America to Boehringer Ingelheim (Germany). In January 2010, it was reported that they assign a part of their business in Australia to Virbac (France). In Japan, the Japanese corporation of Fort Dodge Animal Health (U.S.), a subsidiary of Wyeth (U.S.) is to be integrated in Pfizer Japan Inc. and the Japan Fair Trade Commission is conducting the evaluation as of February 7 when this draft is being prepared. The author believes that they will be integrated without problem. The reason for the author to think so was because the evaluation of the Commission is based on how many companies can compete in the market after the integration and how much the pricing ability will be reinforced after the integration rather than the market share after the integration in the applicable category is too much or not, though it may be an important factor too, when looking at the past cases of the Commission. For example, it concluded that the purchase of Kyowa Hakko Co., Ltd (then) by Kirin (then Kirin Holdings Company, Limited) in 2007 did not "effectively restrict the competition" as there are multiple companies with shares of more than 10% though the share after of the alcohol for alcoholic beverage material reached 65%. On the other hand, as the after-the-integration share of the medical product, G-CSF reached 60% and only two companies could supply it though the share was lower than that of alcohol for alcoholic beverage material by 5%, the Commission concluded that "it may effectively restrict the competition". The among wide-ranging product families held by Pfizer Japan Inc. and Fort Dodge Animal Health K.K., it is assumed that the market share of vaccine for small animals shall attract special attention. According to the author, it is estimated to be slightly over 50%, though there are multiple companies with the share of more than 10% in this market such as Kyoto Biken Laboratories, Inc. (Kyoto Biken) with approximately 20% and Novartis Animal Health K.K. with nearly 10%. Thus, I personally believe that the Fair Trade Commission concludes that "it will not effectively restrict the competition" as the entry into the vaccine for animals is not deemed to present a high hurdle. (Note by Author: The threshold for violation of Anti-monopoly Act used to be deemed 50% of the share before, though the Mergers and Acquisition division, Economic Affairs Bureau of Japan Fair Trade Commission says that it assess the size of influence on the market using "Herfindahl-Hirschman Index (HHI)" which compares the difference of square of shares after the integration rather than the simple share since 2007. Thus, the threshold which "does not restrict the competition effectively (effectively without review)" is any of "HHI 1,500 or less", "HHI 2,500 or less and the increase of HHI is 250 or less" or "HHI more than 2,500 and the increase of HHI is 150 or less" (Figure 1).

Comparing HHIs of veterinary products at Pfizer and Fort Dodge Animal Health in Japan before and after the integration, according to the author's estimate, some of them exceed the threshold when calculating the share of product category in details. However, I believe that the influence is small because they are significantly small compared to the amount of corporate merger).

Criteria which is not usually

Share 10% or less

HHI 1,500 or less

deemed to restrict the

HHI 2,500 or less+the increase of HHI

Share 25% or less

competition (effectively

+HHI less than 1,000

HHI more than 2500 +the increase of

Criteria which is unlikely to

Share 35% or less+HHI less

restrict competition (with

- Share 35% or less + HHI 2,500 or

Geographical Scope of

Domestic market as a principle

Taking the overseas market into

(Reference) prepared by Mizuho Research Institute Ltd. based on the Fair Trade Commission's "Major revision of "Operation guideline of Anti-Monopoly Act concerning the Review of corporate integration"" etc.

Source: Mizuho Research May 2007

Figure l Corporate Integration Policy after Revision which Places Importance on HHI

Then, in the case of the merger between Merck(U.S.) and Schering Plough (U.S.), they also had respective animal health divisions and the integration of their divisions was a big concern of the industry. In particular, Merck had Merial (U.S.) as a joint-capital JV (joint venture) with Sanofi Aventis (France) though it sold the equity holding to Sanofi Aventis in order to address the anti-trust law in Europe at the time of the merger. Sanofi Aventis(France) temporarily owned all the stock of the Merial (U.S.) and had the right to perform the due diligence (research on finance and asset) until the completion of the merger between Merck (U.S.) and Schering Plough (U.S.) and to form the JV again with the new Merck (U.S.) after the merger as an option under the Agreement. As a result, according to the press release on March 9, this right was executed to bring about the No.1 animal health company in the world with the sales of 5.3 billion dollars in simple total across the globe. It is expected that it shall be subject to review if it violates the anti-trust law in the veterinary products market in the future. It must be an important issue how to address the products with overlapping market between former Merial (U.S.) and former Intervet/Schering Plough (U.S.) as a part of the sales strategy. Also, the influence of this newly-born Merial on the Japanese market is large. It is expected that the minute examination and response will be taken so as not to cause confusion in the market, in particular in the sales route. Table 1 shows the trend of the animal health manufacturers in the world presented in the Animal Health Industry Overview held by Brakke Consulting, Inc. on February 16 (2010) during the Western Veterinary Conference.

Table 1 From Animal Health Industry Overview of Mr. Brakke (Extract)

Sales of animal health in overseas market in the last year (2009) decreased by 2% (market size: 18.5 billion dollars) with 1% reduction in U.S.

The low number of launches of new drugs contributes to the slow recovery of business of companies and the major manufacturers may be short of their pipelines. This is also due to the significant reduction of research and development budget.

In order to reduce cost, in 2009 the sales staff tended to be increased even though the number of staff in the administration division was reduced, though in the period from October to December of 2009, they tended to increase the employment of the staff. It is expected that they tend to aggressively increase more personnel in 2010 than in 2009.

The companies addressed the sales reduction by increasing the price by 3-6% in 2008 and 2009, though it will be difficult to continue the price increase in 2010, too.

In U.S., M&A of wholesalers advances to result in the oligopoly situation with 3 companies accounting for 70% of the market of small animal and the increased pressure for discount and bargaining ability on the manufacturers.

The number of visit to animal hospitals and the unit value per visit are decreasing while the sales through internet and catalogue are increasing.

As this M&As between Pfizer and Wyeth and Merck and Schering Plough were conducted under the leadership of medical category rather than the initiative of the animal health business, more M&As may occur among the top 10 ranking companies in 2010.

A significant change shall occur at Japanese pharmaceutical companies. On April 1 this year, it was announced that the domestic sales business involved in the animal and fishery category of Kyowa Hakko Bio Co., Ltd. shall be assigned to Aska Pharmaceutical Co., Ltd. and Kyoritsu Seiyaku Corporation is to be fully integrated with Kawasaki K.K. as of June 1. On July 1, Dainippon Sumitomo Pharma Co.,Ltd. split and spin off animal science business with the DS Pharma Animal Health K.K. as the successor. These three deals are already discovered when the author written this draft, thus the possibility of more restructuring of other companies cannot be denied. According to the press release of Aska Pharmaceutical Co., Ltd, it positions the veterinary product-related business as important category and it is expected that it will try to significantly reinforce the division as the sales of 2.6 billion yen of animal, fishery and small animal products of Kyowa Hakko Bio Co., Ltd. will be added to the current sales of that division of 1.1 billion yen. For Koritsu Seiyaku Corporation, the full integration with Kawasaki K.K. means to become "the company with the stand-alone sales of more than 35 billion yen as the veterinary products manufacturer" and to "establish the No.1 position as the national company" (the quoted portions are extracts from the press release). The spin-off of animal science business by Dainippon Sumitomo Pharma Co., Ltd. is considered to be attributable to the fact that its environment to focus on the core business in full scale become ready because its overseas sales ratio jumped to 40% due to the acquisition of Sepracor Inc. (U.S.). However, this spin-off as animal science business will try to "enhance the level of freedom of management, clarify the management responsibility, accelerate the decision making and increase the profitability by shifting to self-support accounting" (Quoted parts are extracts from the press release). We could also say that the environment to challenge the new mode of distribution or new business which were tough to enter so far considering they were a part of the companies which also operate in the medical product category. 3.

Rapidly-Accelerated Integration and Widening of Animal health Dealers

The trend of wholesalers of veterinary products (hereinafter to be called animal health dealers) has something to do with the shakeup of the distribution of medical products. In 1992, the first distribution shakeup occurred such as "the abolishment of discount compensation system" and "the introduction of market price". It was pointed that manufacturers' approval to give discount to the medical institutions such as hospitals by the wholesalers and to compensate it deprives the price forming ability which should be conducted at the discretions of the wholesalers, leading to selling medical products at extremely low prices and the sharp rise of drug cost in medicine. However, this first distribution shakeup reduced the profit of medical institutions through the difference of drug prices while the medical service fee

which should have offset it did not rise as expected. Thus, the medical institution imposed significant pressure to discount the price on the wholesalers. As they could not receive the compensation from the manufacturers while the prices of the medical products decreased, the gross margin of the wholesalers was reduced, forcing them to significantly lessen the sales administrative expense to prevent the deficit. The gross profit which was 11% in 1996 dropped in 7% range in 2005. The wholesalers entered the era of Mega-Restructuring since the end of 90's for survival, resulting in the birth of mega-scale wholesalers of more than 2 trillion yen and the oligopolistic market where 75% of the medical product market of 8 trillion yen was occupied by 5 major wholesalers

Calendar year (through the courtesy of National Animal Health Product

Equipment Association)

Figure 3 Transition of Number of Animal Health Dealers and Sales Offices

Figure 3 is the survey result of transition of number of animal health dealers and their sales offices in each prefecture in the past 20 years. In the past 20 years, the number of animal health dealers was reduced by 60% from 228 to 94 while the number of their sales offices decreased by slightly more than 30%. Most of them used to be the merger or business integration of animal health dealers in the adjoining prefectures. However, last year, the integration and tie-up of wide-ranging animal health dealers which cover the entire nation, attracting the attention of the industry. Medipal Holdings Corporation has been steadily preparing the integration of wholesale business of veterinary products etc of Everlth Agrotech Co., Ltd. and ATOL Co., Ltd. into its 100% subsidiary Maruzen Pharmaceutical Co., Ltd.and the establishment as MP Agro Co., Ltd. on April 1, 2010 was finally reported. Also, on January 1, 2009, Agro Japan Co., Ltd., Asko Co., Ltd,. and Flet Co., Ltd. announced the business collaboration to name the partnership group "Myodo-kai" and reportedly to promote the partnership implementation project aggressively. Moreover, in June of 2009, Morikubo Inc., and Sundaico Co., Ltd. agreed on comprehensive business collaboration and are reported to jointly considering the sales strategy and new business category in the framework of NPC (Next Paradigm Creator). The author estimate that the total of these three partner groups holds more than 70% of amount in distribution in the veterinary products wholesales market. It is anticipated that they expect stronger price bargaining power towards the manufacturers and the ability to request the sales collaboration as the sales increases of each group through the integration. However, the animal species in which each group is strong, i.e. the animal species in which each group has large share is different, and its home areas vary, too. Thus, in order to maximize the effect of partnership, further restructuring involving other animal health dealers may occur in the future.

Also, many wholesalers secure the position without particular collaboration or integration with other animal health dealers. The gross profit ratios of specialized animal health dealer whose ratio of animal health products account for more than 60% of their product line are 18% on average. It is the strength and the feature of this industry that they have larger primary margin gain than the wholesalers of medical products mentioned above. The product line of manufacturers which became larger through the merger is more varied and it is expected that a manufacturer can cover major categories of veterinary products. Also, it is anticipated that the in-store share of a manufacturer in the sales of the animal health dealer rises significantly. In this case, the control of manufacturer on animal health dealers increases and it can be easily imagined that a manufacturer pursue the integration of animal health dealers under its initiative. 4.

Future Trend of Foreign-affiliated companies and Japanese companies

The market size of the Japanese veterinary products industry is approximately 90 billion yen as the shipment value from manufacturers. It is easy to remember if you simplify it into approximately 30 billion yen for companion animal medical products and nearly 60 billion yen for industrial animal medical products. As for the companion animal products, the additional 30 billion yen from pet foot (therapy food, premium food and supplement) sold through the animal hospital route exists. Considering it from the point of animal health dealers, approximately 20% shall be added to it on amount basis. Comparing the sales of the foreign-affiliated companies with that of the Japanese companies, as for the industrial animal total sales, the sales of the veterinary products manufactured and sold by the Japanese companies still slightly higher however in the companion animal market, 80% is already the products from the foreign-affiliated companies, which is the significant excess of import (more than 90% for the pet foot via animal hospital route). Needless to take an example from the news paper, with the entry of Japan into the aging society with fewer children, the market has passed the growth stage and plunged into the maturity. In addition to it, the deflation has been continuing for many years. This year when I attended the New Year Greeting Meeting of Japan Veterinary Products Association I asked the top management of foreign-affiliated company if they still have the interest in the Japanese market as before to receive the following response. It is an extremely shocking response, however, as I want to share it with the readers, let me introduce it as below. "The Japanese market had large difference of price between the Japanese market and the overseas market and had a large potentiality for the growth giving it a huge appeal. However, since the collapse of the economic bubble in Japan, its growth rate is low and the deflation continues. If the inflation had been continuing in Japan, the sales and the price would have grown due to the inflation even if the market did not expand and the number of units sold did not change. And we could have report that the sales was growing to the headquarters in our home countries despite the effect of the exchange rate. However, in addition to the fact that the sales does not grow even if the number of units sold increased due to the deflation in Japan, the price difference between overseas and Japanese markets disappeared because the market in US and Europe is basically in the inflation though it is only a few percent per year. So even if the prime minister of the former administration said that Japan was No.2 in the sales scale in the world at the international conference, it is just a matter of specific point. If there are other promising area with high growth and larger scale in the neighborhood, we are forced to think to shift the management resource (people, goods and money) to it." This long-lasting concern motivated me to launch the animal health business consultancy since when I was working at my former company. I was convinced that I received the same response as my concern and I heartily agreed that corporate consulting is required with the idea that such circumstance will arrive in the near future. As Japan has population of 1.2 billion, the animal health will not cease to exist immediately as mentioned before. And the foreign-affiliated companies are not yet in the position to shift their bases in Asia other than Japan. And I do not think that the Japanese companies should establish their overseas bases immediately. However, I sincerely hope that the companies which respond to the encouragement of Councilor Yamada as he said in a greeting at the New Year Greeting Meeting "the Ministry of Agriculture, Forestry and Fisheries of Japan intends to provide cooperation so that the Japanese products can be introduced in the overseas market with the development of VICH" and I could provide the cooperation to the best of my ability.

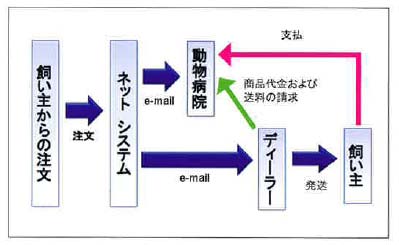

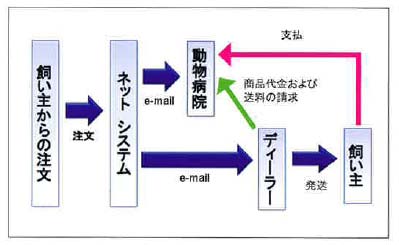

Current Status and forecast of Animal-related Business

One of the animal-related businesses which have significantly grown in the last several years and been socially recognized is "Pet Insurance". The pet insurance was started in UK in 1976. In Japan, many insurance providers shot up in the past with the arrival of the "pet insurance (called as pet mutual-aid at that time)" boom. However, the individual identification had flaws and many troubles as a system at that time resulting in the disappearance of the boom in several years. However, the "animal health insurance" launched in 2000 by Anicom Insurance Inc., which studied such problems in detail has increased the subscriber owing to its easiness to understand to receive the benefit on the spot when the pet owner settles account at the animal hospital, leading to the second "Pet mutual-aid" boom. The dealers to operate the pet mutual aid business as unauthorized mutual-aid have also increased. Thus the Financial Service Agency became the governing authority because it was necessary to develop the system by the governing authority in terms of the protection of consumers, the revision was made to be included in the insurance business under the Insurance Act in April 2006. With its revision, two companies acquired the license as regular insurance companies, 7 companies registered themselves as "small amount short-term insurance provider". However, some unauthorized mutual-aid closed their business because they could not register themselves during the transition period. The number of pet subscribing to the pet insurance which reached 23,000 in 2000 has increased gradually every year and it is estimated that it reached 500,000 in 2009. Anicom Holdings Inc., which controls the group companies including Anicom Insurance Inc. which was authorized as pet insurance company by the Financial Service Agency was listed on Market of the High-Growth and Emerging Stocks on March 3, 2010 on the 10th anniversary of the launch of its service. One of the group companies, Anicom Pafe Inc., publishes the various data of disease trend by dog and occurrence by disease based on the payment record of benefit and independently-conducted survey result as "Family Animal White Paper". This is highly evaluated as the useful activity contributing to the society acting as CSR (Corporate Social Responsibility) of the company. Though the percentage of the subscription is still low with 1.5% of all the kept pets, the subscription rate in UK where the pet insurance was started is 15% and 3% in US. Based on it, the market size in Japan is estimated to be 10 billion yen with the large room for growth. As for other animal-related businesses, the market size of pet sitter and substitute walker for pet is estimated to be 43.5 billion yen, pet hotel to be 37.7 billion yen and pet funeral to be 15.7 billion yen. Also, the animal hospital market size is calculated to be 306.6 billion yen, trimmer and beauty school 118.8 billion yen and the sales of live animals to be 104.5 billion yen. All the market has grown on year on year basis, though only the sales of live animals were lower than the previous year (97.2%) (both for 2007, Source: Pet Business Handbook 2009). The animal-related business service to be launched in 2010 includes the establishment and operation support of online shop of animal hospitals. Some animal hospitals which are supplied with the products from the animal health dealers participate aggressively in the net sales in the last few years and the special therapy food, disinfestations drug of flea and mite and eye drops which were only available at animal hospitals before came to be widely available through the internet to the pet keepers (The sales of veterinary products requires the license for store sales. They cannot sell prescription legend drug.). The author estimates that 3 billion-market is already established. On the other hand, the efforts to provide the service not only to particular animal hospitals but also widely to animal hospitals which wish to receive the net sales service have been made mostly among major animal health dealers. As shown in Figure 4, the order from the pet owner through the internet will be received by both animal hospitals and animal health dealers to deliver the products directly to the pet owners from the animal health dealers. Thus the animal hospitals do not have to worry about the inventory and establish and operate the online shop without preparing designated staff or warehouse. Animal health dealers have a huge merit of not only enclosing the animal hospitals but also extending the reach further to the pet owners. Also, if they launch the service based on the accurate calculate of product price and the shipping charge, they can obtain the necessary profit by promoting the bulk purchase of the pet owners even if the dealers pay the shipping charge. As shown in Figure 4, we build our unique system under the name of "AHRMS DS TM". We accommodate settlement with credit card, COD, bank transfer and postal transfer. In the trial operation implemented since last October with the cooperation of the animal hospitals and animal health dealers, the pet owners tend to purchase to the amount at which the shipping charge will be free and they tend to pay

with the credit cart. What is worth specially mentioning is that all the products are sold at the price prescribed (fixed price) by the animal hospitals and some pet owners have already make regular purchase such as monthly. Also, it is characteristic of this business that many people order heavy food such as 8kg and 14kg. As our partner animal health dealers respond to the order without fail, we have received the orders from our regular pet owners from the first day of the opening of the store and experienced no trouble so far with smooth processing from the order to the shipment. I sincerely wish that this system to be adopted by animal health dealers throughout the nation and to become the social infrastructure to cover the country. This means, that if it is achieved, it is expected that the animal hospitals throughout the nation can open its own online stores and operate it as a form of the order targeted to their customers. In that case, I intend to contribute a part of the system fee and system use fee paid to us to the facilities and NPO which are involved in animal protection for the social contribution.

Invoice for product

Figure 4 Scheme of AHRMS DSTM

Please understand in advance that as the theme on which I was asked to write includes the ongoing circumstance, some of it may not reflect the fact when the JVPA Digest of this manuscript is published. Also, please acknowledge that in order to explain the situation in accordance with the theme, I could not use the alias for various companies and was forced to use the actual names. In order to include the accurate and latest information as much as possible, I made efforts to conduct the overseas research and collect the information with the Bureau of Secretariat waiting for the finish of the manuscript as late as possible. It will be my great honor if this manuscript is of some reference to your business. Feel free to send any opinion or comment to me if you have any comment ([email protected]). As a conclusion, I would like to express sincere gratitude to the Japan Veterinary Products Association, which offered me the opportunity to write this overview.

Reference:

"Shock of Medical Product Industry in 2010" written by Fumiyoshi Sakai (Kanki Publishing)

"Distribution of Medical Products Illustrating the Change 2009-2010" written by Eiji Hodaka (Medical

Publications)

"Animal Health Industry Overview 2010" Handouts, Brakke Consulting, Inc.

"Report on Animal Health Distribution Circumstance 2009 –Resume–" Crecon Research & Consulting Inc.

"Pet Business Handbook 2009" (Sankei Medix)

"Does Information from MR and MS Meet Expectation of Veterinarians?" InfoVets Vol. 12, No.7, Yuki

Ujimasa (Animal Media)

"Can You Maintain Royal Customer?" InfoVets Vol. 13, No.1, Yuki Ujimasa (Animal Media)

M&A of Veterinary products companies

Trii Pharm aceutical Co., Ltd.

Torii Pharmaceutical

Torii Pharmaceutical Co., Ltd.

Torii Pharmaceuticals

Discontinuation of

Co., Ltd. (Merck)

(Asahi Breweries, Ltd.)

Animal health business

Asahi Breweries, Ltd.

be Pharmaceutical

Merged in March 2001

Mitsubishi Chemical Co., Ltd.

Mitsubishi Tokyo

Mitsusbishi Wellpharma

Pharmaceutical Co., Ltd.

Sold off the animal health business in

Tanabe Pha rma Corporation

Sole off animal health business in October, 2002

Pharma Co., Ltd.

Dainippon Sumitomo Pharma Co., Ltd.

o Pharma Co., Ltd.

Split animal health business (scheduled)

Roche Vitamin Japan

DSM Nutrition Japan K.K.

Chugai Pharmaceutical

Discontinuation of animal

Co., Ltd. (Roche)

Chugai Phar maceutical Co., Ltd.

Sold off the animal

Takeda Schering Plough

Intervet (US Merck)

Japan Schering K.K.

Takeda Pharmaceutical

MSD (US Merck Agpet)

(Sanofi Aventis)

Rhone Merieux (animal health division)

Rhone Merieux Zenyaku

Zenyaku Kogyo (some of the animal health divisions)

chi Pharmaceutical

Discontinuation of

animal health business

Upjon Pharmaceuticals Limited

Pharmacia Upjohn

Solvay B ioscience

maceutical Co., Ltd.

a Geigy Co., Ltd.

Novartis Animal Health K. K.

Novartis Animal Health K. K.

maceutical Co., Ltd.

Sold off animal health business

Meiji Pharmaceutical Co. Ltd.

Meiji Pharmaceutical Co., Ltd.

Sold of animal health business

Eisai Co. , Ltd.

Sold off animal health business

Boehringer Ingelheim Shionogi

Boehringer Ingelheim Vetmedica

Nippon Boehringer Ingelheim Co., Ltd.

Teikoku Seiyaku Co., Ltd.

Aska Pharmaceutical Co., Ltd.

Sales of animal health

Grelan Pharmaceutical Co., Ltd.

business (Scheduled)

Kyowa Hakko (Kirin)

Capital Participation

Sold off animal health business

Kawasaki Mitaka K.K.

Kyoritsu Seiyaku Corporation

Source: http://ahrms.jp/e/jvpadigest37.pdf

ABSTRACT MAIN LECTURE Clinical Impact of Missed Anatomy of The Root Canal System Marino Sutedjo General Practitioner, Dentsply, Indonesia ABSTRACT It is generally understandable that a major cause of the failure of root canal therapy is an inability to localize and treat all of the canals of the root canal system. The risk of missing anatomy during root canal treatment is high because of the complexity of the root canal system.

Lithium Jump Starter and DC Power Source MODEL: IMF12000-12 Please read this instruction manual completely before using this product. Retain this instruction sheet for future reference. SHIDO Jumpst w er w. AFAM NV, Belgium. For more info abo P ut oSw HI eDr b