Eng.cam.ac.uk

Real Options: Competition in

Market Regulation and

Cooperation in Partnership Deals

Judge Business School

Fitzwilliam College, University of Cambridge

A thesis submitted for the degree of

Doctor of Philosophy

To my family, for their unconditional love and support.

This thesis is a collection of four papers. The first three papers are written for

an academic audience, while the fourth paper is written with a mixed audience

of academics and managers in mind.

The paper in Chapter 2 is one of the outcomes of collaborative work with Fa-

bien Roques. I was responsible for the development of models and their analytical

and numerical solution, whilst Fabien contributed his expertise in electricity mar-

kets regulation. The collaboration resulted in two working papers, one of them

has an electricity regulation focus and is available as a Cambridge Working Paper

in Economics. The paper included in this thesis has been written by myself and

is largely a summary of my own contribution to the collaboration. In view of

the collaboration, Fabien Roques should be regarded as the second author of this

paper. I would quantify his contribution as 20% of the paper.

The paper in Chapter 4 is part of ongoing joint work with my supervisor Ste-

fan Scholtes. I was responsible for the development of the model and its analysis.

The structuring of the paper was done jointly. Stefan Scholtes is the second au-

thor of this paper. I would quantify his contribution as 20% of the paper.

The papers in Chapter 3 and Chapter 5 are entirely my own work and in-

clude nothing which is the outcome of work done in collaboration, except where

specifically indicated in the text.

I am grateful to my PhD supervisor Stefan Scholtes who never failed

to provide valuable help and support, far beyond the formal supervi-

sor requirements. Working with him has been inspirational. I hope

to prove worthy of the trust he has shown in me.

I would also like to thank the Cambridge Commonwealth Trust for

partially funding my studies through a bursary.

Real Options: Competition in Market

Regulation and Cooperation in Partnership

Judge Business School

Fitzwilliam College, University of Cambridge

A thesis submitted for the degree of

Doctor of Philosophy

This thesis is a contribution to the field of investment under uncertainty. We

develop two new application areas of significant practical importance: regulatory

intervention and cooperation. The thesis consists of two related but stand-alone

The first part investigates the effect of regulatory intervention in the form of a

price cap in an oligopolistic market with irreversible investment under uncertainty.

We find that there is a trade-off between the beneficial effect of regulation on

preventing anticompetitive behaviour and the detrimental effect of destroying

incentives for investment in new capacity. Our contribution is to solve the problem

for an oligopolistic market with time-to-build. Interestingly, the introduction of

price cap regulation, when it takes time to build new capacity, results in three

locally stationary strategies. This multiplicity of solutions has, to the best of our

knowledge, not been observed before in similar real options models.

The second part of the thesis examines real options in projects developed in

partnerships. We present a formal framework, borrowing ideas from cooperative

game theory and efficient risk sharing, to address real options in partnerships.

We conclude the second part of the thesis with an account of a recent R&D

partnership in the biopharmaceutical sector. We identify examples of seemingly

sensible deal structures that lead to surprising and somewhat counterintuitive

results in the presence of uncertainty.

Technical literature . . . . . . . . . . . . .

Investment under uncertainty with price ceilings

Model assumptions . . . . . . . . . . .

Nash-Cournot equilibrium investment strategies . . .

Impact of price ceiling regulation . . . . . . . . .

Nash-Cournot equilibrium with a price cap . . . . .

Sensitivity analysis and simulations . . . . . . . . .

Price cap effectiveness . . . . . . . . . .

Robustness of price cap regulation . . . . . . .

Trade-off between robustness and effectiveness .

Market evolution and the long term effect of price regulation

Simulation parameters . . . . . . . .

Market evolution . . . . . . . . .

Impact of price cap on capacity installed . . .

Impact of price cap on long term average price

Price ceilings with time-to-build

Investment price trigger

Asymptotic behavior of investment price trigger . . .

Time lag tends to zero . . . . . . . .

Price cap tends to infinity . . . . . . .

Investigation of investment price trigger

Equilibrium investment of a symmetric oligopoly . . . . .

Trade off between price cap effectiveness and robustness

Simulation of regulated market with time-to-build . . .

Appendix 1: proof of proposition . . . . . . .

Appendix 2: calculating Z(P) . . . . . . . .

Appendix 3: proof of propositions and . . . .

Real options in partnerships

Options contracts: cooperative vs. non-cooperative options . .

The core of an options contract: an illustrative model . . . .

The core of the deterministic game . . . . . . .

Uncertain payoffs . . . . . . . . . . . .

Complete markets . . . . . . . . . . . .

The contract without options . . . . . .

A cooperative option . . . . . . . .

A non-cooperative option . . . . . . .

No traded assets and risk-neutral agents . . . . .

The non-cooperative option . . . . . .

Cooperative games and risk aversion . . . . . .

Cooperative options and risk aversion . . . . . .

Non-cooperative options . . . . . . . . . .

Cooperative real options games in continuous-time . . . . .

Cooperative options in complete markets . . . . .

Unilateral options in complete markets . . . . . .

Risk aversion in the absence of hedging opportunities . .

Non-cooperative options and risk aversion . . . . .

Managerial implications and conclusions . . . . . . .

A R&D deal in the biotechnology sector

A R&D alliance in the biotechnology sector

The drug research and development process . . . .

Cambridge Antibody Technology . . . . . . .

A framework for analyzing partnership deals in the biotechnology

Effect of uncertainty on R&M contracts

Contracts with flexibility and the effect of uncertainty . . . .

Co-development with an opt-out clause . . . . . .

Portfolio effects and organisational issues . . . . . . .

Enabling exercise of flexibility . . . . . . . .

Conclusions and managerial implications . . . . . . .

Price trigger vs. market concentration

Investment price trigger vs. price cap for N = 2, 4 . . . . .

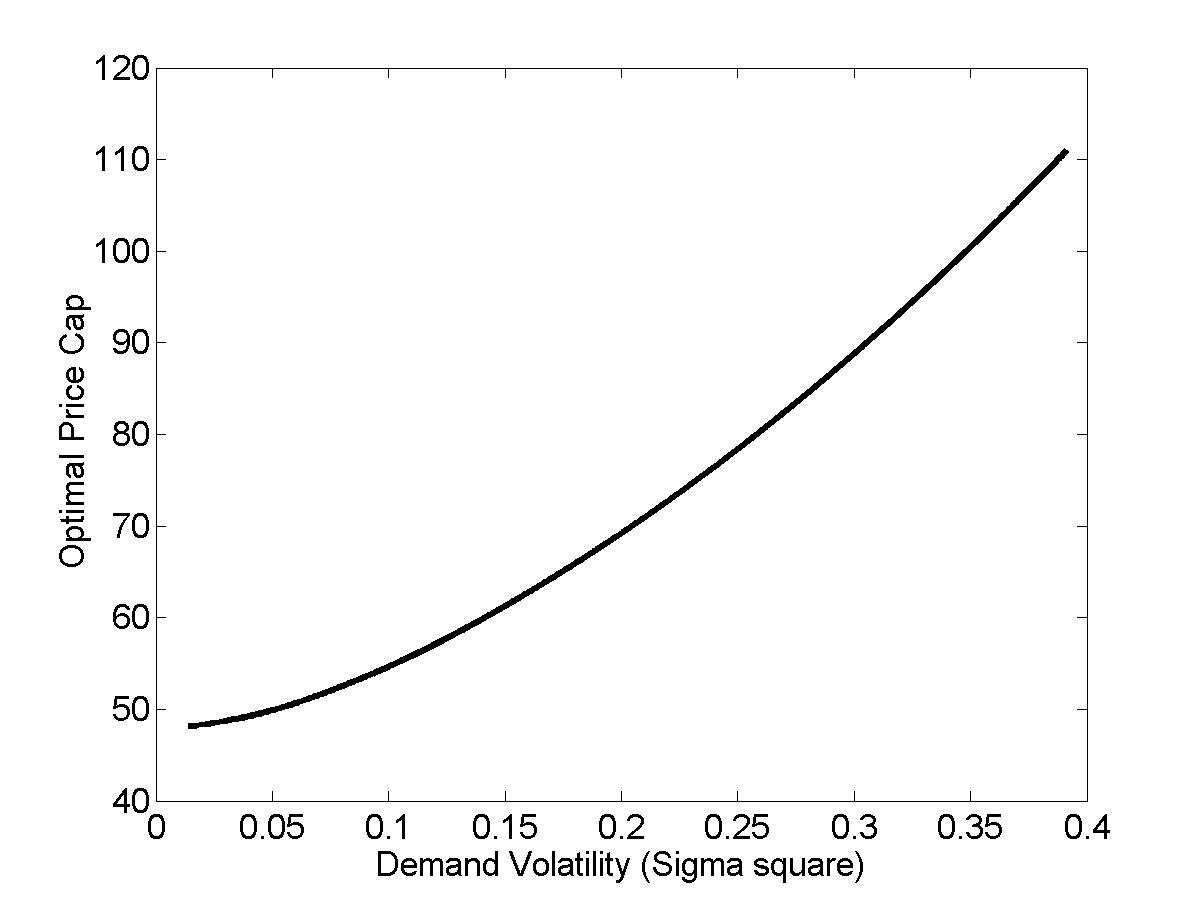

Optimal price cap vs. demand volatility

Maximum effectiveness vs. demand volatility . . . . . .

Robustness vs. effectiveness . . . . . . . . . . .

Base case simulation parameters . . . . . . . . . .

Price and capacity evolution for one demand realisation . . .

Average installed capacity after 10 years (expressed as % of com-

petitive market capacity) . . . . . . . . . . . .

Average markup over competitive price after 10 years . . . .

Investment price trigger vs. price cap, θ = 0.5 years . . . .

Investment price trigger vs price cap, θ = 3 years

Value of the firm vs. price cap . . . . . . . . . .

Investment price trigger at different levels of competition . . .

Globally optimal investment price trigger vs. price cap . . .

Globally optimal investment price trigger vs. price cap . . .

The trade-off between price cap effectiveness vs robustness . .

simulation results . . . . . . . . . . . . . .

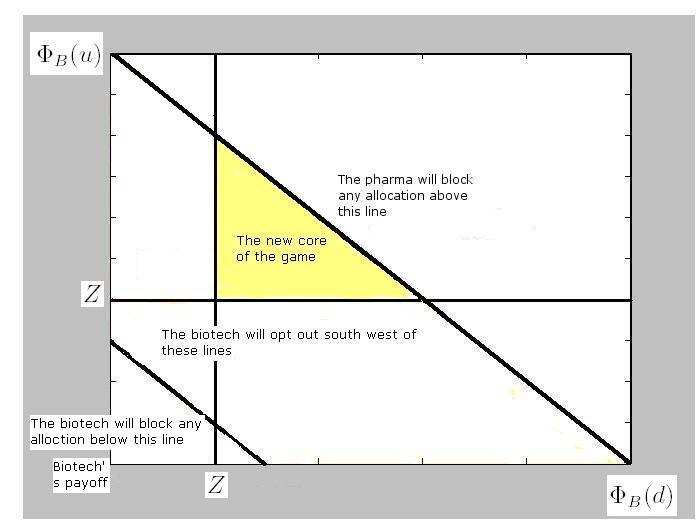

The core of the cooperative game with the biotech having the opt-

Decision Tree: Cambridge Antibody and AstraZeneca R&D alli

Value of R&M contract vs. uncertainty . . . . . . . .

Value of R&M contract vs. royalties . . . . . . . . .

Neoclassical economic theory suggests that a firm should invest in a project when

its net present value (NPV) is positivThe NPV rule is a good decision tool

provided that there is no uncertainty surrounding future cash flows or, alterna-

tively, that the investment is completely reversible. However, most investment

decisions involve both a significant amount of uncertainty as well as investment

irreversibility. Implicitly, the NPV rule assumes that the investment decision

is now-or-never, ignoring the fact that most firms have some freedom over the

timing and the size of the investment.

By undertaking the investment as soon as the NPV is positive, a firm forgoes

the possibility of investing some time in the future. Since future cashflows are

uncertain, waiting gives the firm the chance to learn more about the value of

the investment opportunity. If the future value declines the prudent firm will

not invest, while if the value increases the firm will invest with the reassurance

that this is a good investment. This flexibility is valuable because as it caps

the downside potential without harming the upside. Of course waiting might be

costly, both directly as keeping the option to invest open might come at a cost,

as well as indirectly due to the forgone cash flows. However, if there is enough

uncertainty the value of flexibility might outweigh its costs.

This alternative way of thinking about investments as options on uncertain

cash flow, was developed in the late 1970's by academics working in the field of

1The classic finance text book by for example, includes a chapter

on "Making Investment Decisions with the Net Present Value Rule".

finance (for example As the flexibility inherent

in many projects resembles financial options, the term real options was coined to

describe investment in real

Real options theory advocates that investment decisions must be priced in a

manner similar to financial options using contingent claims analysis. The ratio-

nale behind financial option pricing is that options are redundant assets. Their

payoff can be completely replicated by a portfolio of traded assets. In equilibrium

there should be no opportunities for arbitrage, therefore the price of the option at

any given time should be equal to the price of the traded replicating portfolio. It

is also possible to use the replicating portfolio to hedge all risks from purchasing

an option, so making investment in financial options risk free. The fact that real

options, as opposed to financial options, are written on private assets that are

somewhat unique and are not traded creates some complications for real options

Several suggestions have been proposed in order to overcome this pro

but the debate in the academic community, as well as the practitioner community,

is ongoing. One possibility is to assume that the underlying is traded, construct

an imaginary replicated portfolio and use it to price the investment opportu-

nity. Another possibility is to ignore traded assets all together and use rational

expectations and dynamic programming to price the investment opportunity. Al-

though this method is internally consistent, it ignores market considerations and

hedging opportunities and could potentially mis-price real options. It is worth

noting that although the assumptions behind these two methods are quite dif-

ferent, under certain conditions they lead to similar results. Hybrid techniques

for valuing real options, that explicitly account for both the traded and the non-

traded aspect of the underlying uncertainties, have been developed

with their own shortcomings (including increased complexity). The approach

taken in this thesis is closer to the dynamic programming approach, although it

is also amenable to the contingent claims analysis.

1See e.g. 2See for a recent review.

Despite the lack of consensus regarding the exact mechanics and assumptions

of pricing real options, real options methodology has proved to be a very useful

tool. It is particularly attractive because it explicitly accounts for two important

aspects of investment decisions: uncertainty and flexibility. Real options analysis

provides a framework for understanding what good managers know anyway: Un-

certainty is not necessarily undesirable. Yes it has a negative side, against which

management should try to find shelter but it also has an upside that can be very

profitable. Effectively, flexibility introduces an asymmetry in the effect of uncer-

tainty: it enhances the upside and at the same time it limits the downside. In the

twenty years since real options theory was created it has managed to infiltrate a

number of disciplines. It is used in fields such as yield management

supply chain optimization and strategy

It has also started to make an impact on

engineering and systems design

Most real options theory and application was developed to price investment

opportunities for a monopolist acting in isolation or for perfect competition. Un-

der this assumption, the real option holder, just like a financial option holder,

will base investment decisions only on the price of the underlying asset and does

not need to consider any strategic interactions. However, this assumption is often

unrealistic. In a number of industries, firms that undertake investments have an

impact on market price and thus affect the profits of all firms in the industry.

These firms must base their decisions not only on the stochastic underlying, but

also on the actions of other firms in the industry. Recently, progress has been

made to extend the real options paradigm to include strategic interactions. A

common finding is that the value of real options is eroded by competitive inter-

action and that firms are entering more quickly to avoid preemption

Since competition causes firms to speed up investment, anticompetitive collu-

sion inevitably has something in common with uncertainty: it delays investment.

Of course the reason for the delay is completely different. Uncertainty makes

postponement of investment until the price of the stochastic underlying is quite

higher than investment costs a prudent strategy. On the other hand, anticompet-

itive behavior delays investment in an attempt to gauge prices and reap higher

1.1 Summary of each paper

than normal profits. It is not easy for a regulator to decouple the two causes of

investment delays. What is worse is that sanctions that aim to curb anticompet-

itive behaviour might backfire by destroying investment incentives.

A first theme explored in this thesis deals with real options in regulation. More

specifically, we investigate the effect of regulatory intervention in the form of a

price cap in an oligopolistic market with irreversible investment under uncertainty.

We find that there is a trade-off between the beneficial effect of regulation on

preventing anticompetitive behaviour and the detrimental effect of destroying

incentives for investment in new capacity. Our contribution to the theory of

regulation under uncertainty is to solve the problem for an oligopolistic market

with time-to-build. Interestingly, the introduction of price cap regulation, when

it takes time to build new capacity, results in three locally stationary strategies

instead of one. This multiplicity of solutions has, to the best of our knowledge,

not been observed before in similar real options models.

The second theme of the thesis is real options in partnerships. Traditionally,

real options theory is concerned with the valuation of projects with real options

owned exclusively by one firm. Frequently, projects are developed by a consortium

of firms with different risk profiles and possibly even different strategies. Several

interesting questions arise that traditional real options theory cannot answer. For

example, how should the partnership structure a contract so that it facilitates a

consensus on option exercise strategies? How should they share the value? What

is the effect of unilateral flexibility?

We present a formal framework, borrowing ideas from cooperative game the-

ory and efficient risk sharing, to address real options in partnerships. We con-

clude the second part of the thesis with an account of a recent R&D partnership

in the biopharmaceutical sector. We identify examples of seemingly sensible deal

structures that lead to surprising and somewhat counterintuitive results in the

presence of uncertainty.

Summary of each paper

We now discuss each part in more detail.

Part I: Real Options and Competition in Market Regulation.

1.1 Summary of each paper

Chapter 2: Intertemporal price cap regulation and incentives to

invest in new capacity. The first chapter of Part I of the thesis investigates

the effect of price cap regulation on investment in new capacity at different levels

of market concentration. Although this has been studied in the context of the two

extremes, monopoly and perfect competition

the optimal investment policy for the more realistic oligopolistic market

has not been solved before. We solve this problem and use the model to draw

several interesting conclusions for the regulation of electricity markets.

The contribution of this paper is both theoretical and practical. On the the-

oretical side, we show that there exists an optimal price cap that maximizes

investment incentives and we explain why this happens. Just as in the case of

deterministic demand, the optimal price cap is the clearing price of the competi-

tive market. However, unlike the deterministic case, we show that this price cap

does not restore the competitive equilibrium; there is still under-investment. On

the practical side, we perform sensitivity analysis to examine the effect of price

cap regulation on long-term investment at different levels of demand volatility

and market concentration. The findings demonstrate that price cap regulation is

less effective in volatile markets with high concentration. This casts doubts on

the effectiveness of price cap regulation in mitigating market power in liberalized

Chapter 3: Intertemporal price cap regulation with time-to-build.

The second chapter extends the investigation of the previous chapter to allow for

a time lag between the decision to build new capacity and this capacity becoming

operational. We first solve the problem for a monopolist and then generalize to

a symmetric oligopoly. We find that for stringent price cap regulation, time lag

amplifies the disincentive for new investment already present in models without

time lag. For higher price caps we find that the time lag creates a bifurcation: we

find three locally stationary investment strategies. We characterize the solutions

and provide an intuitive explanation for these results. Rather surprisingly, we

find that sensible price cap regulation is more effective with increasing time to

build, which is rather encouraging from a regulatory point of view.

Part II: Real Options and Cooperation in Partnership Deals

1.1 Summary of each paper

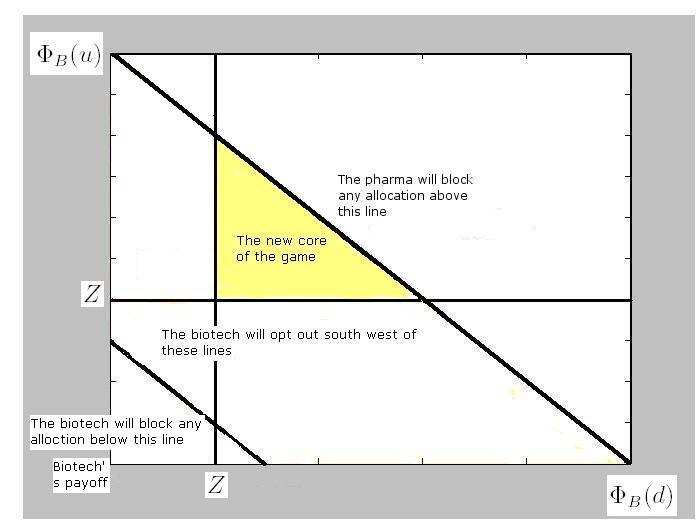

Chapter 4: Real options in partnerships. This chapter integrates prin-

ciples from cooperative game theory and real options to build a framework for

understanding partnership deals under uncertainty. We study partnership con-

tracts under uncertainty but with clauses that admit downstream flexibility. The

focus is on effects of flexibility on the synergy set, the core, of the contract. In

a partnership context, the value of flexibility is captured by the partner(s) who

own the right to exercise. On one side, there are cooperative options which are

exercised jointly and in the interest of maximizing the total contract value, on the

other side there are non-cooperative options, which are exercised unilaterally and

in the interest of the option holders' payoffs. We provide a modelling framework

that captures the effects of optionality on partnership synergies. We study these

effects under a complete markets assumption based on standard contingent claims

analysis. We also look at these effects under heterogeneous risk-aversion using a

dynamic programming model. The model shows the effect of several strategies

on the synergy set and the bargaining position of the partners. It also shows that

non-cooperative options, if agreed prior to the negotiation, are powerful bargain-

ing tools but that they can also destroy a partners' incentive for participating

in the contract. Finally, the model illustrates how risk sharing provides larger

synergies for partners with heterogeneous risk attitudes.

Chapter 5: An R&D partnership case study. We present a case study

loosely based on a recent R&D deal between a Cambridge-based biotechnology

firm and a multinational pharmaceutical company. The case illustrates the ef-

fect of uncertainty and associated flexibility on the value of a contract for two

partners. We present examples of seemingly sensible deal structures that can

lead to undesirable and counterintuitive results in the presence of uncertainty

and flexibility. We then suggest a simple model that can be used to shed light on

such pitfalls. The aim of this chapter is primarily to illustrate the consequences

of neglecting uncertainty in contract design and to help managers build a better

intuition regarding value drivers and value and risk sharing under uncertainty. In

contrast to the three forgoing academically focussed chapters, this last chapter is

written with a managerial audience in mind.

1.2 Technical literature

Technical literature

The main mathematical concepts and results used in this thesis are contingent

claims analysis, dynamic programming, non-cooperative real options games, co-

operative game theory and the theory of risk sharing. This section provides some

references to these tools. It is a high level summary and is neither complete nor

Contingent claims analysis and dynamic programming. The first part

of the thesis investigates the problem of irreversible investment under uncertainty.

There are two methods for solving this problem: contingent claims analysis and

dynamic programming (stochastic optimal control). Contingent claims analysis

makes use of the replicating portfolio argument. Trading in the replicating port-

folio can be used to hedge away all risks associated with the investment and the

future risk-free cash flows are discounted at the risk-free rate. On the other hand,

dynamic programming takes the expectations of risky cash flows with respect to

a subjective probability measure and future cash flows are discounted at a sub-

jective rate that reflects return expectations. Although the assumptions of these

two techniques are quite different, for several real options applications they give

similar results. For a review of both methods as used for real options pricing,

with examples and intuitive explanations, see Chapter 4 of

and for a more in-depth treatment, see

Contingent claims analysis was originally developed to price financial options

by and and earned them the 1997 Nobel

price in economics. The theory is covered in a number of financial mathematics

text books. A very good introductory level book is

while two excellent, more advanced books are and

All of these books cover martingale methods for pricing contingent claims and

also presents deferential equation methods.

Strategic real options: non-cooperative game theory. A good intro-

duction to non-cooperative differential games is the book by

The treatment in this book is mostly deterministic but it provides a good foun-

dation for real option games.

1.2 Technical literature

Strategic real options models attempt to determine the equilibrium exercise

of options, taking into account not only the price of the underlying asset but also

the actions of other firms in the industry. For a review of the literature on real

options and strategic competition see the working paper by

and for a practitioner review see

One approach to determining the equilibrium exercise strategy, adopted by

several authors (for example is to

estimate the equilibrium exercise policy explicitly by considering best response

functions. Although this method is rigorous, it quickly becomes too complicated

to solve for the equilibrium points analytically and even numerically. An alterna-

tive way of finding equilibrium results is to prove that the equilibrium strategy

can be derived as a single agent optimisation problem or that

myopic behavunder certain conditions is optimal see

and The advantage of this method is that it is often

relatively easy to find the strategic equilibrium analytically, however the class of

equilibria studied by these methods is restricted to symmetric equilibria. For our

work we use this second approach.

Cooperative game theory. The second part of the thesis investigates real

options in a partnership. We use theoretical results developed in two areas of

economics: cooperative game theory and risk sharing.

A review of cooperative game theory is presented in while a

review of one of the solution concepts for cooperative games, the Shapley value,

Both of these papers deal with deterministic

cooperative games. With the exception of and

stochastic cooperative games is an area that has not attracted much

Efficient risk sharing, also known as the theory of syndicates, was introduced

by The main concern is how to divide risk between agents in an

efficient way. For recent reviews of the theory see and

1In this context, a myopic firm is a firm that takes investment decisions fully acknowledging

uncertainty in the underlying asset, but without taking into account strategic interactions.

Baldursson, F. 1998. Irreversible investment under uncertainty in oligopoly. Journal of

Economic Dynamics and Control 22 627–644.

Baxter, Martin W., Andrew J. O. Rennie. 1996. Financial Calculus: An Introduction

to Derivative Pricing. Cambridge University Press.

Black, F., M. Scholes. 1973. The pricing of options and corporate liabilities. Journal

of Political Economy 81(3) 637–59.

Borison, Adam. 2005. Real options analysis: Where are the emperor's clothes? Journal

of Applied Corporate Finance 17(2) 77–31.

Boyer, M., E. Gravel, P. Lasserre. 2004. Real options and strategic competition: a

survey. 8th annual real options conference .

Brealey, R.A., S.C Myers. 2003. Principles of corporate finance. 7th ed. McGraw-Hill.

Brennan, M.J., E.S. Schwartz. 1985. Evaluating natural resource investents. Journal

of Business 58 135–157.

Burnetas, A., P. Ritchken. 2005. Option pricing with downward-sloping demand curves:

The case of supply chain options. Management Science 51(4) 566–580.

Christensen, P., G. Feltham. 2002. Economics of Accounting, vol. 1. Kluwer Academic

de Neufville, R., S. Scholtes, T. Wang. 2006. Asce journal of infrastructure systems.

Real Options by Spreadsheets: Parking Garage Case Example, 12 107–111.

Dixit, A., R. Pindyck. 1994. Investment under uncertainty. Princeton University Press.

Dobbs, I. 2004. Intertemporal price cap regulation under uncertainty. Economic Journal

Dockner, E., S. Jorgensen, N.V. Long, G. Sorger. 2002. Differential games in economics

and management science. Cambridge University Press.

Etheridge, Alison. 2002. A course in Financial Calculus. Cambridge University Press.

Gallego, G., G. Iyengar, R. Phillips, A. Dubey. 2004. Managing flexible products on a

network. CORC Technical Report TR-2004-01, Columbia University Department

of Industrial Engineering and Operations Research, New York.

Grenadier, S. 2000. Project flexibility, Agency, and Competition, chap. Equilibrium

with Time-to-build: A Real-options Approach. Oxford University Press.

Grenadier, S. 2002. Option exercise games: an application to the equilibrium investment

strategies of firms. The Review of Financial Studies 15(3) 691–721.

Henderson, V., D. Hobson. 2002. Real options with constant relative risk aversion.

Journal of Economic Dynamics and Control 27 329–355.

Knudsen, T.S., B. Meister, M. Zervos. 1999. On the relationship of the dynamic pro-

gramming approach and the contingent claim approach to asset valuation. Finance

and Stochastics 3 433–449.

Lambrecht, Bart. 2001. The impact of debt financing on entry and exit in a duopoly.

Review of Financial Studies 14(3) 765–804.

Leahy, J. 1993.

Investment in competitive equilibrium: The optimality of myopic

behaviour. The Quarterly Journal of Economics 108(4) 1105–1133.

MacMillan, I.C., R.G. McGrath. 2002. Crafting R&D project portfolios. Research

Technology Management 45(5) 48–59.

Merton, R.C. 1973. Theory of rational option pricing. Bell Journal of Economics and

Management Science 4 141–181.

Myers, S.C. 1984. Finance theory and financial strategy. Interfaces 14 126–137.

Neely III, JE, R. De Neufville. 2001. Hybrid real options valuation of risky product de-

velopment projects. International Journal of Technology, Policy and Management

Nefsci, Salih. N. 2000. An introduction to the Mathematics of Financial Derivatives.

2nd ed. Academic Press.

Pratt, J. 2000. Efficient risk sharing: The last frontier. Management Science 46(12)

Smit, H., L. Trigeorgis. 2004. Strategic Investment . Princeton University Press.

Smith, E.J., R.F. Nau. 1995. Valuing risky projects: Option pricing theory and decision

analysis. Management Science 41(5) 795–816.

Suijs, J., P. Borm. 1999. Stochastic cooperative games: Superadditivity, convexity, and

certainty equivalents. Games and Economic Behavior 27(2) 331–345.

Suijs, J., P. Borm, A. De Waegenaere, S. Tijs. 1999. Cooperative games with stochastic

payoffs. European Journal of Operational Research 113(1) 193–205.

Thijssen, J.J.J., K.J.M. Huisman, P.M. Kort. 2002. Symmetric equilibrium strategies in

game theoretic real option models. CentER Discussion Paper, Tilburg University

Wilson, R. 1968. The theory of syndicates. Econometrica 36(1) 119–132.

Winter, E. 2002. The Shapley value. Robert J. Aumann, Sergiu Hart, eds., Handbook

of Game Theory with Economic Applications, chap. 53. Elsevier.

Young, H.P. 1994. Cost allocation. Robert J. Aumann, Sergiu Hart, eds., Handbook of

Game Theory with Economic Applications, chap. 34. Elsevier, 1193–1235.

Investment under uncertainty

with price ceilings in oligopolies

We study the impact of price controls on the level and timing of investment in an

oligopolistic (Cournot) industry facing stochastic demand. We find that a price

ceiling affects investment decisions in two mutually competing ways: it makes

the option to defer investment more valuable, but at the same time it reduces the

incentive for firms to strategically underinvest in order to raise prices. We show

that while sensible price cap regulation speeds up investment, a low price cap

can be a disincentive for investment. There exists an optimal price cap level that

maximizes investment incentives and reduces long term prices. This optimal price

cap is independent of market concentration but is less effective and less robust to

model parameters as market concentration and demand volatility increase.

Keywords: Real options, stochastic games, price cap regulation, electricity mar-

JEL code: C73, D92, L51, L94.

Price cap regulation was implemented for the first time in the UK in the early

1980s to regulate the newly privatized telecommunication market that emerged

after the privatization of British Telecoms. Steven Littlechild, who recommended

this measure to the British government envisaged the price

cap as a transitory measure that would eventually wither away as competition

came in. The point of the price cap was to ‘hold the fort" until competition

arrived. However, it has taken longer than expected for utility industries to

become competitive, and price cap regulation has gained popularity in many

countries as a permanent form of regulation in the utilities industry.

points out that although price cap regulation appears to be

successful in establishing incentives within the regulatory period for cost effi-

ciency, questions remain regarding its ability to induce appropriate investment in

the long term, and in particular in the presence of demand uncertainty. Models

have been developed to investigate this question in the extremes of competitive

markets and monopoly

This paper contributes to the debate on price regulation by studying the impact

of a price cap on the level and the timing of irreversible investment under uncer-

tainty for a Cournot oligopoly. Both monopoly and perfect competition can be

thought of as special cases of our model.

Interestingly, we find that when demand is stochastic price regulation affects

investment decisions in two mutually competing ways. On the one hand, it pro-

vides a disincentive for investment as it caps potential upside profits while leaving

potential downside losses unchanged thus making the option to defer investment

valuable. On the other hand, the presence of a price cap reduces the incentive

for firms to strategically underinvest in order for the price to increase. Since the

price cap prevents firms from increasing their profits by inducing price increases,

profit maximizing firms can only boost their profit by investing in new capacity

in order to increase production. Because of these two mutually competing incen-

tives, it is not clear a priori whether a price cap speeds up or delays investment.

We find that for low price caps, the option to defer effect dominates, while for

high price caps close to the unregulated industry entry price, the market power

mitigation effect dominates. Hence sensible price caps can speed up investment

as compared to the unregulated Cournot oligopoly, while low price caps can be

counterproductive and could slow down investment.

The next practically interesting question is whether there exists a price cap

that maximizes investment incentives in the market by lowering the price trigger

as far as possible. This price cap brings the industry investment strategy as close

as possible to the competitive market. The two mutually competing effects of a

price cap on investment incentives imply that there exists such a price cap. This

should be located at the point where the effect of alleviating strategic under-

investment is beneficial enough without making the option to defer investment

too valuable. We show that this optimal price cap is independent of the number

of firms active in the industry and corresponds to the perfect competition entry

price, in a similar way to models with deterministic demand (e.g.

However, unlike deterministic models, setting the price cap at the

competitive level does not produce the competitive investment outcome; there is

still underinvestment compared to the competitive market.

Examining the effectiveness of the price cap, we find that it is more beneficial

when the market is concentrated and demand is not very volatile. The range

of beneficial price caps becomes narrower the more volatile the demand and the

more concentrated the market. Moreover, the impact of an error in the estimate

of the optimal price cap is asymmetric because underestimation can be more

damaging than overestimation.

These results yield important practical insights for regulators and shed light

on some of the potential pitfalls of price cap regulation. Price caps are mainly

used in the utilities industries, such as telecoms, electricity, gas

but have also been implemented in a va-

riety of concentrated markets. For example, report

price controls in the intrastate deliveries market, the automobile insurance pre-

mia charged in California and the medical services for Medicare and Medicaid

patients. An empirical investigation on the effect of controls in the form of zon-

ing laws in real estate development has shown that regulatory restrictions can

hasten development This has provided some empirical

verification that indeed regulatory controls that curb profits can speed up in-

vestment. In the utilities industry, our findings apply more particularly to the

current debate on wholesale price caps in the electricity industry, which was the

2.2 Literature review

impetus for this work. Electricity markets remain concentrated in many coun-

tries and exhibit extremely volatile demand which is subject to frequent regime

jumps. This renders estimation difficult for regulators and can lead to an erratic

choice of the price cap Our findings give some weight

to the defenders of higher wholesale electricity market price caps in the US, who

argue that the current price caps are too low and will lead to delayed investment

in peaking units

The rest of the paper is organized as follows. In section 2 we present a liter-

ature review. Section 3 introduces the model and the Nash-Cournot equilibrium

solution in the absence of price cap regulation. Section 4 investigates the effect of

price cap regulation on investment. We demonstrate that there exists an optimal

price cap that speeds up investment and we find a closed form solution for it. We

study the effectiveness and robustness of price cap regulation and complement

the results by Monte Carlo simulation in section 5. Finally, section 6 presents

a summary of our main findings, discusses the practical relevance of these in-

sights within the perspective of the regulation of utilities industries (particularly

electricity), and presents suggestions for further research.

Literature review

There is an extensive amount of literature focussing on various aspects of price

cap regulation in an atemporal context, such as efficiency and incentive issues or

complex tariffs (e.g.

and The literature which takes a

dynamic perspective on price cap regulation has concentrated on price construc-

tion processes and their potential manipulation by regulated firms

as well as comparisons of price cap regulation with traditional rate-of-

return regulation. For example, uses a model with stochastic costs

to compare price cap versus rate-of-return regulation, focuses on differences in

the timing of hearings and the amount of cost information collected. Alterna-

tively study the dynamics of price regulation for

an industry adjusting to exogenous technological change, and show that price

2.2 Literature review

cap regulation leads to more efficient capital replacement decisions compared to

provides an extensive review of the price cap regulation lit-

erature and points out that questions remain regarding its efficiency to induce

appropriate investment in the long term, and in particular in the presence of

demand uncertainty. There have been a few attempts to assess the impact of

price cap regulation in the presence of demand uncertainty. For example,

use a one time period model of Cournot competition with uncertain

demand to show that price cap regulation in the presence of uncertainty might

fail to increase production and therefore fail to increase consumer welfare. Their

model is more general than ours as it shows that a price cap might fail to decrease

prices for very general demand specifications. However, it is limited to one time

period and therefore does not permit the investigation of the long term effects of

a price cap on investment in a dynamic intertemporal perspective.

Our work examines the impact of a price cap in a continuous time model and

belongs to the recent field of strategic real option literature. The theory of real

options uses tools developed to price financial derivatives to price investment op-

portunities (see for example or

provide an extensive review of the various applications

of this theory in monopolistic and competitive industries. A common feature of

models of investment under uncertainty, besides a number of simplifying assump-

tions, is that the solution of the problem involves an investment price trigger.

When the price rises to the investment price trigger firms find it optimal to in-

vest in new capacity, therefore lowering the price. More recently, the theory of

strategic real options has been developed by combining real options arguments

with differential games in order to model investment in oligopolistic industries

Our model builds on

who shows that the more competitive the industry, the lower

the investment price trigger. Strategic real options models rely on transforming

the Nash equilibrium from a fixed point problem to a single agent optimization

problem, a technique first demonstrated in the seminal paper of

demonstrated that the option exercise strategy of a myopic firm

(that ignores competitive interaction) coincides with the equilibrium strategy of

2.2 Literature review

a firm that fully acknowledges the possibility of competitive entry. Our work

makes use of these results in order to find the Nash equilibrium solution in the

presence of price caps.

A few models which make use of such an intertemporal approach to study

the impact of a price cap on investment timing and level have been developed.

The first such model was presented in and

where the impact of price control in a perfectly competitive market is studied.

They find that such regulatory interventions are uniformly detrimental and slow

down investment because they introduce a disincentive for investment. Thus

regulatory intervention is capping potential upside profits while leaving potential

downside losses unaffected. uses a similar model to study the case

of a monopoly. Our model is more general and bridges the gap between these two

models as it studies oligopolistic (Cournot) competition. As the number of firms

is increased to infinity, we retrieve results similar to those of

and when the number of firms is equal to one, we retrieve results similar

Turning to the practical applications of our model, the amount of empirical

literature focusing on the price cap regulation of utilities industries is growing.

and provide a review of the

nascent empirical literature on the impact of price cap regulation on investment.

study extensively both theoretically and practically

the access pricing problem of bottleneck facilities in network industries such as

telecommunications. There is also an extensive literature debating the impact

of wholesale price caps on investment in electricity markets (e.g.

use a two period model, with more realistic

features than our model, to examine the detrimental impact of low wholesale

price caps on investment in peaking units. use nu-

merical simulations to study the long run effect of price caps on investment in

new generation units under different market structures. Our model, although not

capturing the peculiarities of electricity markets in as much detail as the above

mentioned papers, complements them insofar as it uses a continuous time dy-

namic approach. Consequently our model yields insights on the impact of a price

cap on investment timing as well as level.

In the following section we present the model and outline and discuss the main

assumptions used.

Model assumptions

Assumption 1 The market clearing price is given by the aggregate inverse de-

mand function which takes the isoelastic form:

P (t) = X(t)Q(t)− 1γ

were X(t) is the exogenous component of the demand, Q(t) is the aggregate quan-

tity supplied to the market and γ is the elasticity parameter.

The use of such a constant elasticity demand function is common in seminal

game theory models, for example and

The same demand specification is also employed in real options

models, for example

Such a demand specification simplifies the search for closed form solution and

it has the desirable property that it always gives a positive price

Furthermore, as noted by this demand specification has

one degree of freedom (the elasticity constant γ) which allows for sensitivity

Assumption 2 The exogenous component of the demand X(t) follows a geomet-

ric Brownian motion (GBM) given by the equation:

dX = Xµdt + Xσdz

where µ is the drift of the demand process, σ is the instantaneous standard

deviation and dz is a Wiener process

1This can be extended to more general Ito processes.

This specification implies that X(t) is lognormally distributed. GBM is a

fairly general process whose use is widespread in the real options literature even

though concerns are frequently voiced about its shortcomings. For example, it is

often argued that a mean reverting process is more natural because there exists an

equilibrium demand, from which deviations are not sustainable. However, as the

focus of this paper is on long term investment decisions, using a mean reverting

process instead of GMB has been found to have little impact on cumulative

investment in a similar settings (see

There are N symmetric firms active in the industry, all producing the same ho-

mogenous non-storable good (for example electricity), using the same production

technology. All N firms sell their output in a frictionless market at a single node.

At time t each of the N firms produces an amount qi(t). The total quantity

produced at time t is:

Assumption 3 Setting variable and fixed costs to zero, the profit πi(t) each pro-ducer receives at time t is defined by:

πi(qi(t), Q−i(t), X(t)) = X(t)Q(t)−1/γqi(t)

where Q−i(t) is the aggregate production of all firms but firm i at time t.

Under this demand specification firms will always produce at full capacity,

provided that the market is concentrated enough or that demand is elastic enough

such that N γ > 1. As demonstrated in Appendix 1, under the assumption that

N γ > 1 the marginal value of producing is always positive (for all values of the

uncertain demand X) and therefore a firm would produce up to its capacity limit.

For the rest of the paper we assume that this is the case and since firms produce

at full capacity, the aggregate supply in the market is equal to the aggregate

For simplicity we assume that there is neither technological progress nor phys-

ical asset depreciatFurthermore, we assume that there is no risk of unex-

pected technical failure. We also assume that all firms discount future cash flows

at the same rate ρ

The sequencing of the game is as follows: firms produce at full capacity and

sell their output in a frictionless market. Demand is revealed and the market

clearing price is determined through equation Each firm receives its payoff

and then decides whether to expand capacity at a fixed and irreversible cost of

C per unit or to waWe assume capacity is infinitely divisible and becomes

available instantaneously. Investment in new capacity is assumed to be completely

irreversand since firms produce at full capacity this is equivalent to qi(t)

being a non-decreasing function of time. The game is repeated in continuous

Firms continuously maximize their profit by expanding capacity whenever

such a strategy is profitable. The maximization problem of firm i at time t

consists of determining the firm's investment strategy so that it maximizes its

expected profit including the cost of increasing capacity. Each firm therefore

1Both technological progress and physical depreciation could be incorporated in the model as

extra discount rates, for example see This assumptiondoes not change the qualitative nature of our results and is omitted for simplicity.

2If there exists a traded asset (or portfolio of assets) that completely spans the uncertainty

in demand, then all the investment decisions that firms take can be perfectly replicated bytrading in this asset. Trading in the replicating portfolio allows a firm to hedge away all of therisks it is facing. Thus the investment becomes risk free and the correct discount rate for futurecash flows is the risk free rate. In the absence of a traded asset ρ is a subjective discounting rate.

In such a case the discount rate could be higher than the risk free rate to reflect firms' costs ofcapital. Since we are assuming identical firms throughout this paper, we will also assume thatin the absence of complete markets all firms use the same subjective discounting rate ρ.

3Alternatively, we could view this as a two stage game, where firms decide how much to

produce up to their capacity limit and then decide whether to increase capacity at an irreversiblecost C per unit. The two stage game is reduced to a one stage game provided that there areno production costs and N γ > 1 as shown in Appendix 1.

4Investment is irreversible in the sense that firms cannot sell some of their capacity if

demand declines.

faces a sequence of investment opportunities and must determine an exercise

Firms' investment decisions affect not only their own cash flow but also the

market clearing price through equation Therefore, the optimal investment

strategy has to take into account other firms' investment decisions. It is deter-

mined as part of a Nash equilibrium where firms compete

a la Cournot. At each

time t, firm i will decide whether to increase capacity or not in order to maximize

its expected operating profit, taking into account that increasing its own capacity

impacts competitors profits and vice versa

Definition 4 The capacity expansion problem of firm i can be formulated as a

stochastic optimal control problem where the expectation operator E is conditional

on the initial state (qi0, Q−i0, X0

J (qi0, Q−i0, X0, qi(t), Q−i(t), X(t)) =

π(qi0, Q−i0, X0, qi(t), Q−i(t), X(t))e−ρtdt

The first term in the functional of equation represents the expected sum

of all profits from present and future operations. The second term represents the

expected costs of expanding capacity. Both cahsflows are suitable discounted.

Nash-Cournot equilibrium investment strategies

We restrict the analysis to symmetric Nash-Cournot equilibrium, so that at time

t, qi(t) = Q(t)/N for all firms. We follow and

in their simplified approach to derive symmetric Nash-Cournot equilibrium

strategies. and build on the seminal paper

1Alternatively, we can think of each firm as owning a sequence of call options on the stochas-

tic price of the output. The strike price is the investment cost. However, each firm fully recog-nises that the price process is endogenous: the exercise of such options by its competitors willimpact its own profits by reducing the market clearing price and vice versa.

2If there is exists a replicating portfolio then the expectation is taken with respect to the

risk neutral measure, while in the absence of a replicating portfolio the expectation is takenwith respect to a subjective measure.

by to demonstrate that the symmetric Nash equilibrium investment

strategy coincides with the investment strategy of a myopic firm that ignores

competitive aThe importance of this simplification is that it reduces the

search for a Nash equilibrium from finding the simultaneous solution of N optimal

control problems to the standard real options problem for a single firm.

Proposition 5 The marginal value mi of the symmetric Nash-Cournot equilib-rium investment strategy of firm i is given by the following differential equation:

and the free boundary conditions:

1. Value matching condition at the investment trigger P ∗

mi(P ∗, Q−i, qi) = C

2. Smooth pasting cat the investment trigger P ∗

∂mi (P∗, Q−i, qi) = 0

Proposition 6 The investment price trigger P ∗ is given by:

P ∗ = C (ρ − µ)

(β1 − 1) (N γ − 1)

where β1(µ, σ, ρ) = 1 − µ +

Proof See Appendix 2.

and show that besides the monopoly and perfectly

competitive industry cases, it is also possible to solve the oligopoly case as a single firm opti-mization problem. The procedure is just to pretend that the industry is perfectly competitive,maximizing a "fictitious" objective function, using an "artificial" demand function.

2The smooth pasting conditions in this continuous time model are akin to the first order

necessary conditions for value maximization in a static optimization model.

2.4 Impact of price ceiling regulation

The first two terms are familiar. P = C(ρ−µ) represents the investment price

trigger in a competitive industry without uncertainty (e.g.

p.151). This price is the zero Net Present Value (NPV) point in the sense

that if there is no uncertainty, a firm increasing capacity infinitesimally every

time the price hits this points (which happens continuously) will be receiving

a zero economic rent. The term

> 1 is often referred to as the option

value multiplier It is the classic real options result

that in the presence of uncertainty, even under perfect competition, firms should

not invest as soon as the NPV is positive but they should rather wait until the

NPV is positive enough to make the possibility of not recouping their irreversible

investment small.

> 1 can be interpreted as a market power mark-up. That

is, the investment price trigger for the oligopoly P ∗ is equal to the competitive

investment entry price trigger (P ∗

) multiplied by the oligopoly mark-up α.

Figure illustrates the impact of market concentration on the investment

trigger in an oligopolistic industry and a perfectly competitive industry with and

without a price cap. The investment price trigger is a decreasing function of the

number of firms, and since the oligopoly mark-up α > 1, firms in the oligopolistic

industry only add capacity when prices reach values that are higher than would

be necessary under perfect competition. Prices are therefore uniformly higher

under oligopolistic competition, while installed capacity is less.

In the limit of perfect competition (as N goes to infinity), α tends to 1

and the investment price trigger P ∗ of equation tends towards P ∗

, which corresponds to the investment price trigger in a perfectly

competitive industry (see Moreover, when N = 1,

α = γ , which corresponds to the monopoly mark-up as in

Impact of price ceiling regulation

Let us now assume that prices are capped at a predetermined level P by the

regulator. In this section, the price P given by equation represents the true

market clearing price only when the price cap is not binding. When the price

2.4 Impact of price ceiling regulation

Price Trigger vs Market Concetration

Investment price trigger (% of competitive investment trigger)

Competitive investment trigger

C = 600, σ2 = 0.3, µ = 0.03, γ = 0.6, ρ = 0.08

Figure 2.1: Price trigger vs. market concentration

cap is binding, the true price consumers have to pay is the price cap. There-

fore the price given by equation can be interpreted as the hypothetical

market-clearing or ‘shadow' price (see p. 298) which

is monotonically related to the pressure of demand. In the next section, when we

investigate the price that would trigger new investment, we will be referring to

this ‘shadow' price instead of the actual price.

When the price cap is binding there is a mismatch between supply and de-

mand: the demand is higher than the aggregate supply. We assume that excess

demand is rationed in an efficient way. This is a standard assumption in several

models studying price cap regulation (e.g. p. 297 and

Nash-Cournot equilibrium with a price cap

Definition 7 The profit πi for firm at time t is given by:

πi(qi, Q−i, X) = min XQ−1/γqi, P qi

2.4 Impact of price ceiling regulation

where Q−i is the aggregate production of all firms but firm i at time t.

We denote by P the investment price trigger at which it is optimal for firms

to invest in more capacity when a price cap P is implemented. Note that this

trigger refers to the shadow price, i.e. the hypothetical market clearing price.

A price cap higher than the natural investment trigger is simply irrelevant, as

voluntary investment decisions will always generate enough capacity to keep the

price below the price cap. In other words, the regulator must implement a price

cap P ≤ P because P is a reflecting boundary for the price process.

Solving the stochastic optimal control problem of equation using the

profit function of equation is more complicated than the problem of the

previous section. We now have to solve a differential equation in two different

price regimes: binding and non-binding price caps. The details of the proof are

presented in Appendix 3. We present below the main result:

Proposition 8 When the regulator caps prices at P , the investment price trigger

P as a function of the price cap is given by:

is the investment price trigger of the competitive

β1(µ, σ, ρ) =

β2(µ, σ, ρ) =

Proof See Appendix 3.

It is worth noting that the investment price trigger is a convex function of the

price cap. This implies that there exists a price cap that is a global minimum

for the investment price trigger. We will investigate this price cap in the next

section. Before we do this, it is worth investigating what will happen if the

2.4 Impact of price ceiling regulation

regulator sets the price cap at the investment price trigger for the unregulated

oligopoly (P = P ∗). Intuition would suggest that such a price cap should not

have an effect on the investment price trigger as it will only be binding at the

moment firms invest in new capacity. Indeed, after some algebra, it is possible

to show that the regulated investment price trigger is equal to the unregulated

price trigger P (P ∗) = P ∗.

Optimal price cap

It is reasonable to assume that the goal of a regulator overseeing an oligopolistic

market is to influence the market to become as competitive as possible. For this

reason the regulator will choose the price cap level that minimizes the investment

price trigger by solving the problem:

We call this optimal price cap P opt.

Proposition 9 The optimal price cap P opt is given by the following expression:

N =∞ = C (ρ − µ) (β1 − 1)

Proof See Appendix 5.

Under uncertainty, the optimal level of the price cap is equal to the com-

petitive industry investment trigger price P ∗

. Equation indicates that

the optimal price cap in this intertemporal model does not depend on market

concentration, but does depend on the volatility of demand through β1.

Using the expression of the optimal price cap of equation and of the

investment price trigger equation we obtain:

Since P opt is the optimal price cap, the investment price trigger given by the

equation is the lowest possible investment price trigger the regulator can

2.4 Impact of price ceiling regulation

Figure 2.2: Investment price trigger vs. price cap for N = 2, 4

Investment Price Trigger vs Price Cap

Oligopoly trigger N=2

Trigger with price cap (N=2)

Trigger with price cap (N=4)

Oligopoly trigger N=4

Perfect Competition Trigger

induce for the oligopolistic industry. Since beta2 < 0, as the number of firms

increases the investment price trigger approaches the perfect competition invest-

ment price trigger from above. For finite values of N this investment price trigger

is always higher than the competitive trigger. Even when the regulator does not

allow firms to charge higher prices than they would have been able to charge

under prefect competition, she is not restricting the timing of the investment.

Since oligopolists can still choose to time their investment differently than they

would under perfect competition, they can still earn positive rents.

Figure illustrates the point that the optimal price cap does not restore

the competitive market outcome. Furthermore it also illustrates that the optimal

price cap does not depend on market concentration. What can also be observed is

that there is a range over which the price cap has a beneficial effect by lowering the

investment price trigger. We examine this region with the following proposition:

Proposition 10 There exists an interval (P min, P ∗) over which the introductionof a price cap P ∈ (P min, P ∗) lowers the investment price trigger compared to the

unregulated investment trigger (i.e. P < P ∗).

2.4 Impact of price ceiling regulation

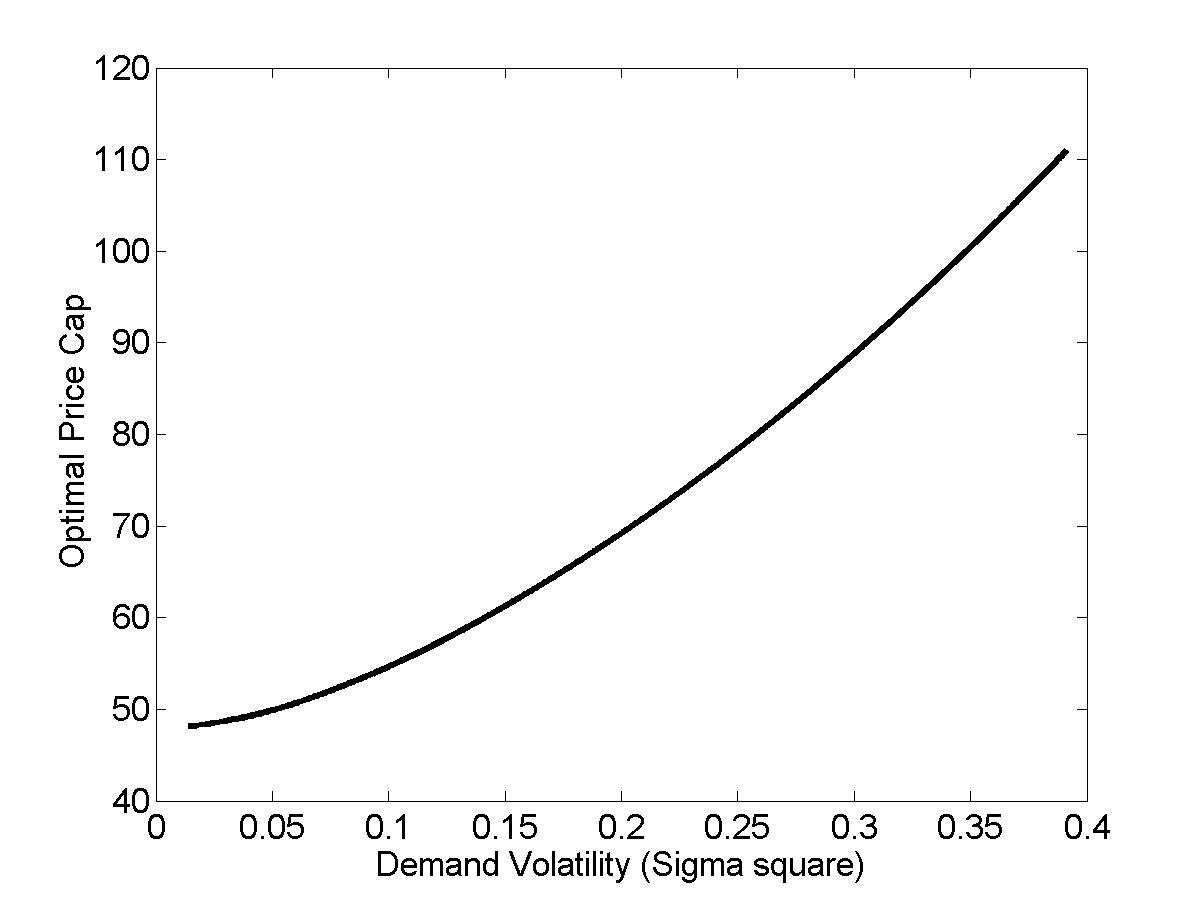

Figure 2.3: Optimal price cap vs. demand volatility

C = 600, σ2 = 0.3, µ = 0.03, γ = 0.6, ρ = 0.08

Proof See Appendix 4.

This result generalizes Dobb's(2004) result which is obtained in the case of

a monopoly. Figure illustrates that the bounds of the interval (P min, P )

depend on market concentration. The less competitive the industry, the lower

P min and the larger P . Figure shows the impact of demand volatility on the

optimal price cap P opt.

The effect of price cap regulation on investment incentives under oligopolistic

competition is not monotonic with respect to the price cap due to two effects

working in opposite directions: the option value effect and the strategic underin-

vestment effect.

A price cap has a negative impact on the value of new capacity. It caps po-

tential upside profits while leaving unchanged potential downside losses, thereby

providing a disincentive to investment. In order to commit new capacity, firms

require demand pressure to be high and hence the price cap to be binding for

some time. Hence a tighter price cap implies that a greater current pressure of

demand is necessary to trigger new investment, thereby becoming a disincentive

for investment.

2.4 Impact of price ceiling regulation

As explains in his model of perfect competition:

If the imposed price cap is so low that at this point the return on

capital is only just above the normal rate, then investors want to be

assured that this state of affairs will last almost forever before they

will commit irreversible capital.

Under symmetric oligopolistic (Cournot) competition without price cap, the value

maximizing strategy of a firm is not to increase capacity as quickly as the perfectly

competitive market in order for prices to increase. However, when there is a

binding price cap the optimal strategy might change. An infinitesimal increase in

capacity will not lead to a reduction in price, the price cap will still be binding,

but it will lead to an increase in profits because each firm is producing and selling

more. Hence a price cap provides an incentive to invest in new capacity. In other

words, a price cap reduces the ability of firms to leverage their market power

by keeping capacity low. Consequently, a tighter price cap should reduce the

investment price trigger P and thereby induce more investment.

A price cap has therefore a dual impact on the investment price trigger of an

oligopolistic industry. This explains the two regimes observed in figure Over

the interval (P opt, P ∗), the positive effect of the price cap on strategic underin-

vestment dominates the negative impact of the price cap on the option value of

waiting, so that the investment price trigger P

is an increasing function of the

level of the price cap P . For a price cap lower than the competitive entry price

P opt, the impact of the price cap on the option value of waiting dominates, such

that the investment price trigger P

is a decreasing function of the level of the

price cap P .

Moreover, the implementation of a price cap lower than P min would be coun-

terproductive, as it raises the investment price trigger above the oligopolistic

investment price trigger without a price cap. As the price cap is lowered to

zero, the investment price trigger tends towards infinity, as in the case of perfect

2.5 Sensitivity analysis and simulations

Sensitivity analysis and simulations

In this section we investigate the effectiveness of price cap regulation and the

robustness of the price cap. We conclude the section with a comparison of long

term prices and average installed capacity in the presence and in the absence of

sensible price cap regulation.

Price cap effectiveness

In section 4 we found that under uncertainty price cap regulation cannot force

firms' investment strategies to be identical to the strategies of firms in a compet-

itive industry. This was illustrated in figure Even at the optimal price cap,

there will be underinvestment compared to the perfect competition and firms will

earn positive rents.

In this section, we quantify how effective a price cap can be in retrieving the

Definition 11 We define the price cap effectiveness coefficient � by

P ∗(P ) − P ∗

where P ∗ is the investment price trigger for the unregulated industry, P

investment price trigger when the regulator caps prices at P , and P ∗

is the investment price trigger of the unregulated competitive in-

Maximum effectiveness is achieved when the regulator imposes the optimal

price ceiling (P opt). In this special case, the effectiveness coefficient is given by

�∗ = N γ − (N γ − 1)(1 −

The price cap effectiveness coefficient � takes the value of one if the price cap

retrieves the perfect competition investment strategy and it is zero if the price

cap does not change the Cournot oligopolistic investment strategy

1An interesting extension left for further research would be to study the impact of a price

2.5 Sensitivity analysis and simulations

Figure 2.4: Maximum effectiveness vs. demand volatility

Price Cap Efficiency

Demand Volatility

Figure shows that price cap regulation is more effective for less concen-

trated markets. This has a straightforward explanation closely related to the

strategic underinvestment effect. In a highly concentrated market, unregulated

firms have an incentive to be very slow in investing in new capacity in order for

prices to increase. A price cap reduces the ability of firms to leverage their market

power in order to increase prices - although not completely as firms can still play

on the timing of new investments. The more competitive the market, the less

market power can be leveraged by firms rendering the price cap less useful.

More interestingly, figure shows that the effectiveness of price cap regu-

lation is crucially dependant upon how uncertain demand is. High demand un-

certainty tends to make price cap regulation ineffective. This can be intuitively

explained by the option effect. Uncertainty (measured here by demand volatil-

ity) makes the option to defer investment in new capacity valuable; a company

wants to be fairly sure that it will recoup the irreversible cost of investment be-

cap on market efficiency, i.e. on a measure of social welfare such as the sum of firm profits andconsumer surplus. A proper evaluation of the latter would require a more detailed study ofquantity rationing and explicit modeling of consumer surplus.

2.5 Sensitivity analysis and simulations

fore committing to invest. A price cap reduces the upside potential gains without

affecting the potential downside losses, therefore making it necessary for a firm

to wait for even higher demand before committing to invest. Therefore increased

uncertainty reduces the effectiveness of price cap regulation because it amplifies

the value of postponing investment.

Robustness of price cap regulation

As it is evident from figure the price cap that maximises investment incentives

is the global minimum of the function P . In the previous section we investigated

how effective this price cap is in making the market more competitive. Another

interesting issue for a regulator is the question of how robust the optimal price cap

is to model parameters. This has important implications for regulators in markets

where demand volatility is difficult to estimate and is subject to structural breaks

or macroeconomic shocks.

Figure shows that the optimal price cap depends crucially on demand

volatility. For example, if volatility is missestimated to be 10% instead of 20%

the optimal price cap will be misscalculated to be 54.7 instead of 69.2. What is

the magnitude of the impact of such a large (21%) underestimate of the optimal

price cap on investment?

In this section we concentrate on this question by defining a robustness coef-

ficient and investigating the trade-off between price cap effectiveness and robust-

ness. We also examine the effect of not taking into account the uncertainty in

demand when setting the price cap. We find that, as a rule of thumb, it is better

to overestimate demand volatility and to set a price cap that is too high rather

than setting a price cap that is too low.

Trade-off between robustness and effectiveness

Definition 12 We define the robustness (r) of a price cap as:

where P min is the smaller solution of P (P ) = P ∗.

2.5 Sensitivity analysis and simulations

Figure 2.5: Robustness vs. effectiveness

Robustness Vs Effectiveness

Robustness coefficient

In other words, it is the lowest price cap that produces an investment price trigger

equal to the price trigger of the unregulated industry. Any price cap lower than

P min would be counter productive as it raises the investment price trigger. So

the robustness coefficient is a measure of how much error in the estimation of

the price cap it takes in order for the price cap to be counterproductive and slow

down investment.

As can be seen from figure a regulator can choose to increase the robust-

ness of the price cap by setting a price cap that is higher that the optimal price

cap. However, this comes at a loss of effectiveness. The new price cap does not

speed up investment as much as the optimal price cap. We investigate this trade

Figure shows that price cap regulation is not only more effective the more

concentrated the market is, but is also more robust. Furthermore, it is possible

to increase the robustness of a price cap but this happens at the expense of

2.5 Sensitivity analysis and simulations

effectiveness. The upper part of each graph corresponds to price caps set higher

than the optimal level, while the lower part of the graph represents price caps set

lower than optimal. Figure shows that setting the price cap higher is always

better than setting it lower than the optimal price cap because of the effectiveness

A general insight from our model is that it is better to overestimate

demand volatility than it is to underestimate it. Significant underestimation has

the potential to make regulatory intervention counterproductive by slowing down

investment beyond the level of the unregulated oligopolistic market. In contrast,

significant overestimation can only render the price cap irrelevant; it will not slow

down investment.

Market evolution and the long term effect of price

In this section we aim to provide some insights on the magnitude of the investment

delays caused by the exercise of market power and the effect of optimal price cap

regulation. We simulate several realizations of the stochastic demand and we

observe the corresponding capacity expansion and price

Simulation parameters

The parameters for the simulation model were chosen to be representative for

We do not pretend to offer a precise characterization of

investment in electricity markets due to the model's stylized nature (e.g.

for a more realistic, but static two period model of price

caps in electricity markets). Rather, the aim of this section is to provide some

insights into the order of magnitude of the quantitative impact on the delays and

underinvestment identified in the previous sections.

Electricity markets are characterized by several features that make them a

good test case for our model. Electricity markets exhibit high demand volatility

and in many regions are not very competitive.

both these reasons, a variety of price control mechanisms related to technical

1Numerical solutions and simulations were implemented in MATLAB. The code is available

from the authors upon request.

2.5 Sensitivity analysis and simulations

Base case parameters

Fixed investment costs

Demand growth (µ < ρ)

Risk free discount rate

Number of firms (N > 1/γ)

Initial production quantity

Optimal Price cap

Initial inverse demand

Figure 2.6: Base case simulation parameters

dispatch constraints or market power mitigation procedures are suspected to have

a detrimental impact on investment incentives. This is particularly the case for

peaking units which earn most of their revenues at periods of high prices (e.g.

Table summarizes the default simulation parameters. Initial capacity is

normalized to one as we are interested in comparing the relative level of invest-

Figure shows one path of realized prices in three cases: perfect competition,

unregulated oligopoly and optimally regulated oligopoly. The investment price

trigger of the regulated oligopoly is lower than the investment price trigger of

unregulated oligopoly, but remains higher than the investment price trigger under

perfect competition. The lower right hand side figure shows the evolution of

capacity in all three cases. It shows that although the regulated oligopoly is

investing more in new capacity than the unregulated oligopoly, it still does not

invest as much as the competitive industry.

This section presents a Monte Carlo simulation to gain some insight into the

long term effects of price cap regulation on both investment in new capacity and

2.5 Sensitivity analysis and simulations

Figure 2.7: Price and capacity evolution for one demand realisation

Oligopoly (N=3) without Price Cap

Oligopoly (N=3) with Optimal Price Cap

Investment Trigger

Investment TriggerReal Price

Perfect Competition

Evolution of Capacity

Perfect Competition

Investment Trigger

Oligopoly with Optimal Price Cap

C = 600, σ2 = 0.3, µ = 0.03, γ = 0.6, ρ = 0.08, N = 3, X0 = 160.

average prices.

Impact of price cap on capacity installed

We compute the average installed capacity after 10 years over 10,000 demand re-

alizain the case of unregulated oligopoly, regulated oligopoly and perfectly

competitive industry and calculate the following ratios:

• QOlig represents the ratio of the average installed capacity after 10 years of

an unregulated oligopoly to that of the perfectly competitive industry.

• QOPC represents the ratio of the average installed capacity after 10 years of

a regulated oligopoly to that of the perfectly competitive industry.

Table shows the extent of underinvestment caused by market power for

a range of values of the base-case parameters of table The results of the

1The standard errors using 10,000 were always less than 4%.

2.5 Sensitivity analysis and simulations

Figure 2.8: Average installed capacity after 10 years (expressed as % of compet-itive market capacity)

simulation suggest that the impact of imperfect competition on installed capacity

can be quite significant. Both the unregulated as well as the unregulated firms